Written on February 15th, 2018 10 minute read

The Impact of a Starbucks Latte

Every morning around the country coffee-fanatics line up in droves, waiting for that favorite cup of Joe. Not only can the wait be long, but it can be more than $5 a cup! Which should beg the question… how much does your morning cup really cost?

On one side, we have people who get the occasional coffee every month. On the other side, we have the group that can’t go a day without their orange mocha frappuccino (you know who you are)… let’s look at the daily coffee camp.

To start, if you’re buying a $5 cup each day of the week, you are spending $1,825 each year. If that doesn’t sound expensive enough, consider the income you need to earn to sustain this morning ritual. Using a 15% marginal tax rate, you must earn $2,098 each year. To someone who makes $50,000 a year ($24 / hour) that’s 87 hours or two weeks of working each year!

Kicking the habit or making it yourself would put $1,825/year in your pocket – sounds simple, minus the potential coffee withdrawals. But what if we took this to the next level?

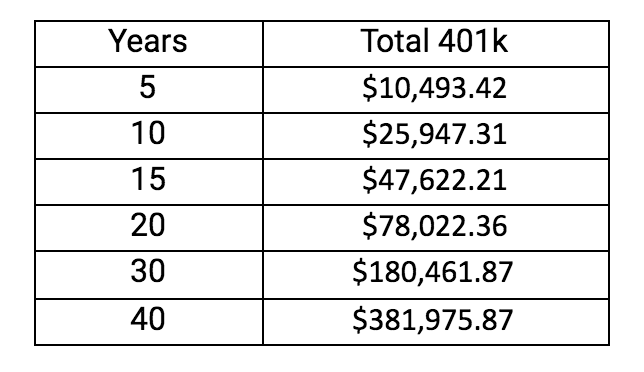

Investing the savings into retirement accounts

If you dumped that $1,825 into retirement on January 1st of each year, here’s what your estimated balance would look like over time:

Assumptions: 7% annual rate of return, lump sum invested on Jan 1 of each year, return calculated without fees

That’s the power of compounding.

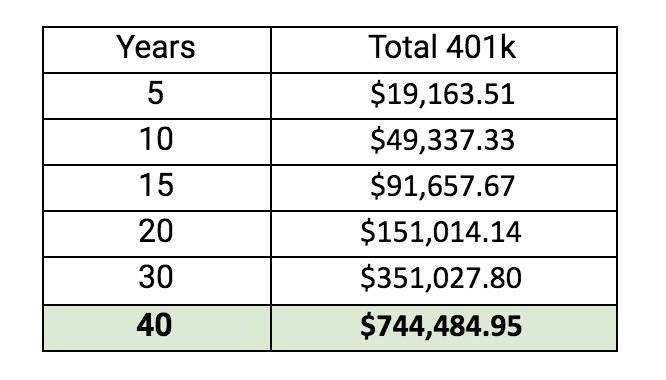

But since we’re talking about retirement, it’s only fair we discuss the employer match. Here, an employer may match the dollars you contribute towards your 401k. There are limitations to the amount they might match (check with your HR department), but let’s assume they’ll match the $1,825 dollar-for-dollar.

Now your investment becomes $3,650 each January 1st, and the results are staggering.

Assumptions: 7% annual rate of return, lump sum invested on Jan 1 of each year, return calculated without fees. Employer matches $1,825, investment becomes $3,650 each year

If a 22 year old beginning their career made this one change in their daily routine, they would have roughly $744K by age 62, and they’d break $1M by their 67th birthday.

Saving the equivalent of a daily Starbucks latte could allow working Americans to retire on schedule.

Even if you don’t have or aren’t taking advantage of an employer-sponsored 401K or match, looking to cut a small habit is worth considering. Redirecting even a handful of dollars a day can go a long way. It’s worth noting, the retirement problem in America is very complex. There are, of course, other factors contributing to the broader issue; but this is for the individual to consider.

When small, everyday habits compound, they create extraordinary gains.

Habits are at the center of everything we do. Everyone has experienced this situation; you’d like to workout more often, but things come up and you never end up at the gym. Perhaps you find there isn’t enough time to get to the things you care about and love. Why? You may feel as though your decisions and routines are repetitive; like you’re driving your car on autopilot. We fail to recognize that we control the habits that we form and, thus, the direction of the car.

“We first make our habits, then our habits make us” -John Dryden

While not everything is within your control, existing habits can stop you from reaching your goals. Be an informed driver and decide the route you want to drive based on the conditions; not on the routine.

“It’s the daily practice of all the monotonous, little, boring things like brushing your teeth that matter the most. There’s no single event. There’s no one thing I can tell you you have to do. It’s an accumulation of lots and lots of little things, which any one by themselves [are] useless, yet together add up.” -Simon Sinek

When it comes to money, turning a small expense into a small savings could make you a millionaire. The same exponential return is seen across other areas of your life.

Want to become more insightful?

- Read about a new subject for 15 minutes each day

Want to raise your EQ?

- Meditate for 5 minutes each day

Want to become a more empathetic leader?

- Put down your smartphone before stepping into meetings; give your reports 20 minutes of undivided attention each day

Similar to retirement investing, small habit changes will be subtle at first, but they add up and compound over time. It’s with patience and commitment to betterment, that we can achieve slow, yet incredible gains.

What’s your Starbucks latte?

Whichever area it falls into, it may just make you a millionaire.