Written on March 1st, 2018 8 minute read

Ninety-Percent of life is about showing up… on time

Compounding interest is perhaps one of the most important and powerful discoveries of our time.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

– Albert Einstein

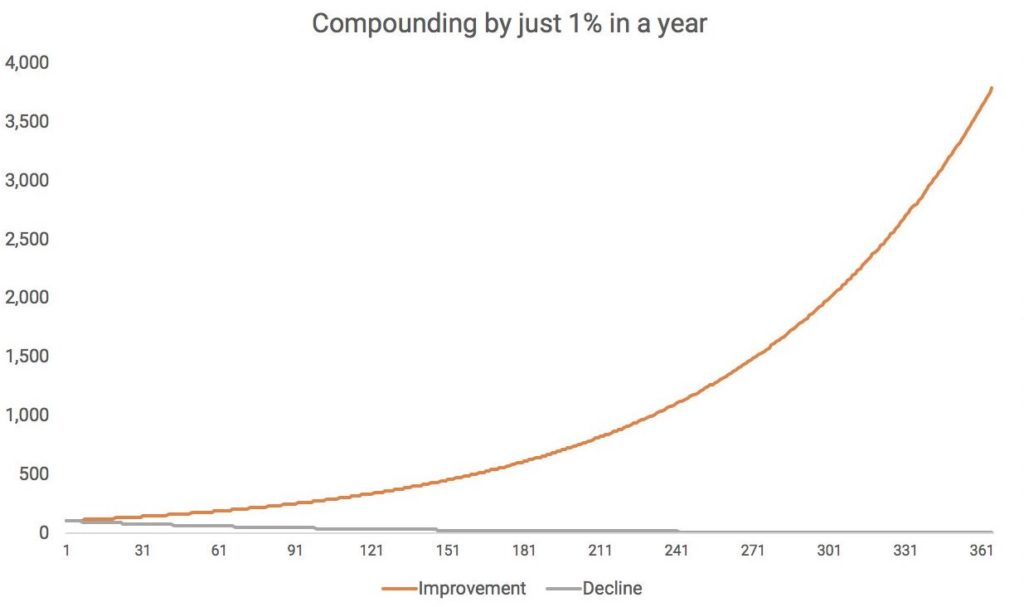

Einstein wasn’t just referencing money when he said those wise words; in nearly every domain of life, compounding can either make or break you. If for example, you only get 1% better everyday for a year, versus 1% worse, you’ll be over 1000% better by end of year.

When you break it down, success is actually played at the margins; it’s about getting slightly better each day over a long period time, instead of dramatically better in one fell swoop. [James Clear on Marginal Gains]

The classic example is saving for retirement. When you start early and stay consistent, accumulating a large nest egg becomes much easier. With an Employer Match, a 20 year old could invest as little as $5 each day to retire a millionaire by 67 (The Impact of a Starbucks Latte).

If you imagine compounding as a Dr. Seuss-like machine, there are two ingredients going in to create varying levels of “Success” that come out the other side: TIME (when you start) and INVESTMENT (deliberate practice).

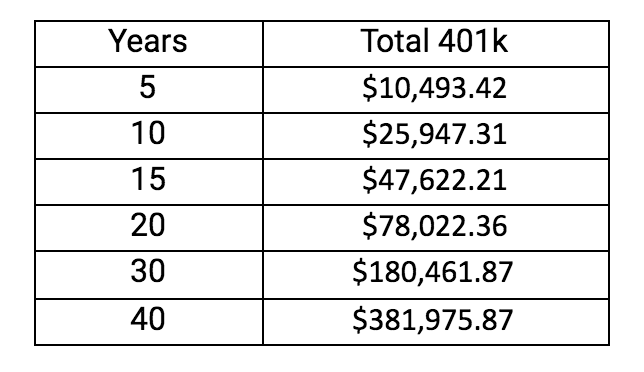

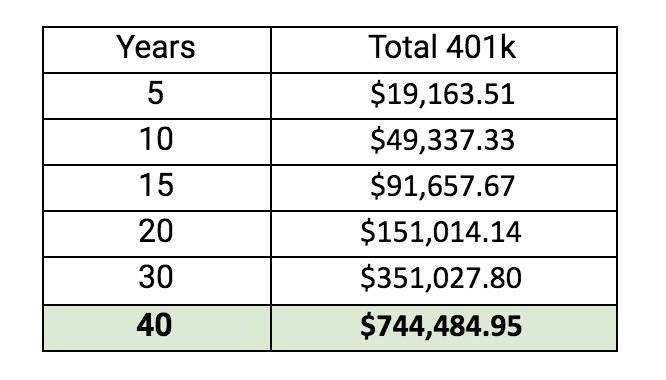

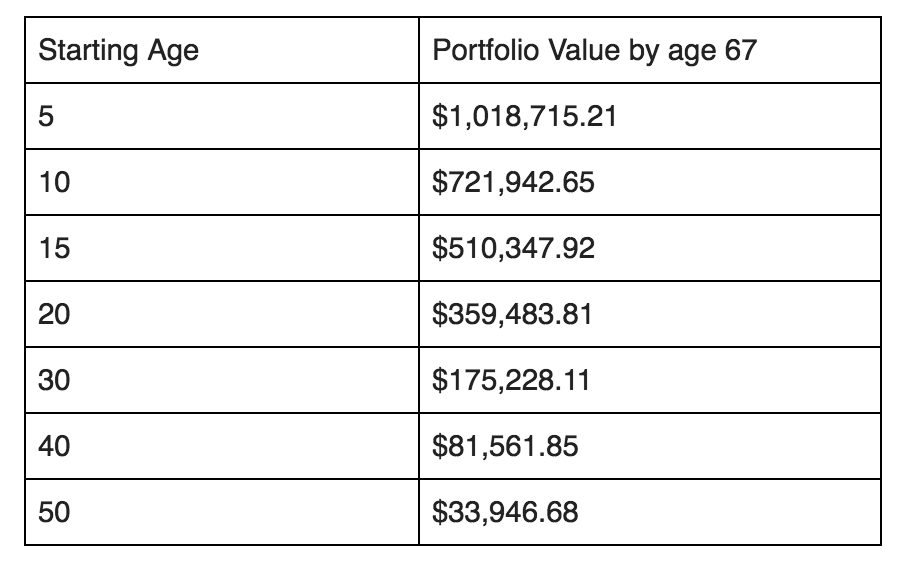

Here’s the best part about it, you control both inputs. Given the first example (1% better), you can see that, if time is on your side, you actually don’t need to invest nearly as much. However, the longer you wait, the more you’ll need to catch up. If you contribute $1,000 each year into an investment account, which compounds at 7% each year, below is the final balance you’d have by age 67, based off what age you START:

If you start at age 5, you’ll be a millionaire. Say you wait until half way through this chart (31 years old) to begin, you’d end up with a mere 17% of the total opportunity.

Perhaps the more powerful input you control is how early you start, not how much you invest.

Intellectual Compounding told by greats

“An investment in knowledge pays the best interest.”

-Benjamin Franklin

Most people know about financial compounding, but few recognize intellectual compounding. That is, the same exponential curve can apply to your growth as a thinker, an entrepreneur, or any related skill. If we were to plot how much you push yourself to learn, we see the same 1% better trend lines. By learning everyday, you become better at learning new things and adapting to your environment; it’s not a linear relationship, but instead an exponential lift.

“Read 500 pages every day. That’s how knowledge works. It builds up like compound interest.”

-Warren Buffett

The prolific speaker, Tony Robbins, has also acknowledged this phenomenon. When Tony started his career, he wasn’t nearly the presenter he is today. In fact, Tony says one of his co-workers was much better than him, which made Tony wonder why. What was difference between them? Did his co-worker have a gift that Tony was incapable of? Not even close. Tony realized he was only giving 1 presentation a week, whereas his co-worker was giving about 3 a week. So to be better, Tony quit his job and started giving 3 presentations a day. In about 2 months time, Tony gave the equivalent number of presentations that the other guy would give for the rest of the year.

Tony massively elevated his deliberate practice, but he also started early. While his fame emerged after his first book release at age 28, his first job as a motivational speaker was at age 17 – a full 11 years earlier.*

“The most important thing to do is start investing now so you can unlock the power of compounding.”

-Tony Robbins

We typically over-praise the individual versus their positive habits, environment, or commitment to growth. Whether you’re starting a business, a new job, or working towards an ambitious goal, compounding is the secret sauce that gets less attention. When we think of becoming great in any domain, we usually think about working harder and longer than the proverbial other guy. Instead, we should be thinking about starting one day earlier than ‘the other guy’.

Timing needs a higher priority

Working hard is the easier part; it’s not difficult to wake up an extra hour earlier or stay at the office after hours if it’s something that you find deep purpose and potential in. Figuring out when to start though, that’s hard.

“Bookstores have an entire ‘how to’ section but not a ‘when to’ section… [Yet] timing… can be everything.”

-Eric Barker (This is the Time)

Perhaps we can simplify this though; start now. There are probably millions of great ideas waiting to be unlocked, but we’re too afraid or too slow to start. When you understand compounding, you give timing the attention that it deserves. Successful people understand this and it’s why, when they get asked about their biggest regret, many of them answer that they wish they had started sooner.

One of my favorite high school teachers used to say, “Ninety-Percent of life is showing up on time.” He would go on long tangents about the value of time, whenever someone arrived late to class. Ironically, we’d end up spending anywhere from 5 to 15 minutes of class time listening to him dissect the topic. To him, it was imperative to show up, but the more important point was to be on time.

Reflecting more than a decade later, I believe he understood something much deeper about timing. If you want to be the next Mozart, you can’t wait 30 years to begin learning piano, you need to show up when the opportunity first strikes. When you’re late to start, you miss much more than just the opening credits of a movie; you miss the character development, the plot, in fact, you never reach the conclusion. Using compounding interest, a late entry could reduce your returns by 100x; that’s the chance to learn, grow, or become your best self.

To take advantage of our total potential, we need to be on time.