Last week Jack Bogle passed away. A true financial great, Jack made some of the most pivotal contributions to finance and investing throughout his career. Don’t just take my word for it, even other legends agree:

“If a statue is ever erected to honor the person who has done the most for American investors, the hands down choice should be Jack Bogle.

In his early years, Jack was frequently mocked by the investment-management industry.

Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me.”

Warren Buffet, Berkshire Annual Letter 2016

In this writeup, I outline my favorite Jack Bogle lessons, all of them have applications outside of money management and may be applied in wider ways across your life. The quotes within are taken from, “The Bogleheads’ Guide to Investing“

Compounding Interest

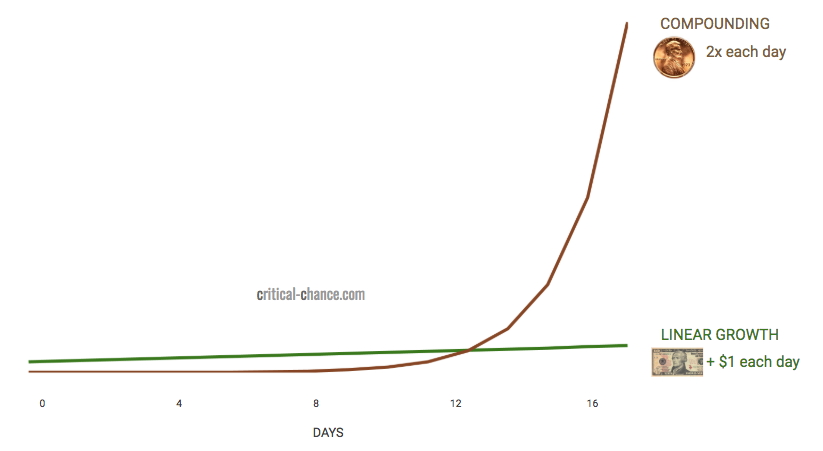

The best gains in life grow in a compounding fashion; returns continue to grow on top of prior returns. The amounts your money can earn in Year 1 will be far smaller than year 2, year 3 or year 5.

“It may not seem like a big deal, until you realize that every time the money doubles, it becomes 4, then 8, then 16 times your original investment.

Start with one penny and double it every day, on the thirtieth day it compounds to $5,338,709.12.”

LESSON: Most people search for linear gains. Instead, set your pursuits on investments that can yield compounding results.

Related: The Impact of a Starbucks Latte

Start Early

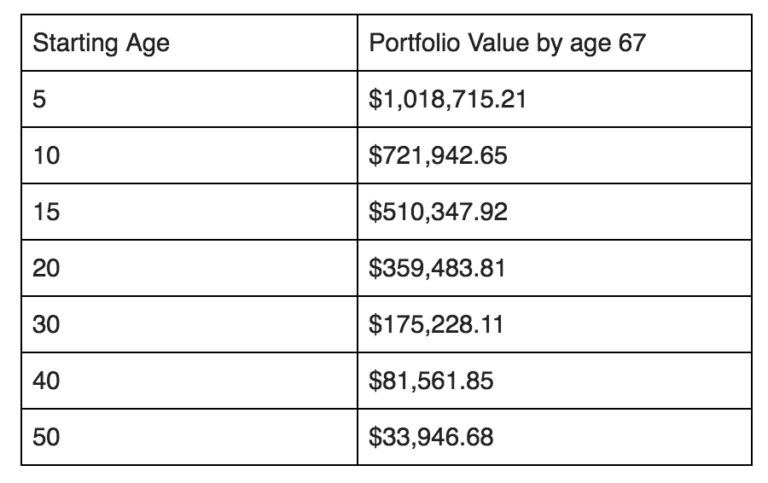

If your young, your greatest advantage is starting earlier than your competition. “The best time to plant a tree is twenty years ago. The second best time is now.” The old proverb goes. At face-value, a few years doesn’t sound like much, until you account for compounding interest.

“Let’s assume a child is born today. For the next 65 years, she or her parents will deposit a certain amount into a stock mutual fund that pays an average annual return of 10 percent.

How much do you think they need to deposit each day in order for her to have $1 million at age 65? Five dollars? Ten Dollars?

In fact, a daily deposit of only 54 cents compounds to more than $1 million in 65 years.

It really helps to start early.“

LESSON: The most important thing you can do is start today. Forget about the marginal progress you’ll make on Day 1, it’s the fact that you got off the couch and began that matters most.

Related: Ninety-Percent of life is about showing up on time

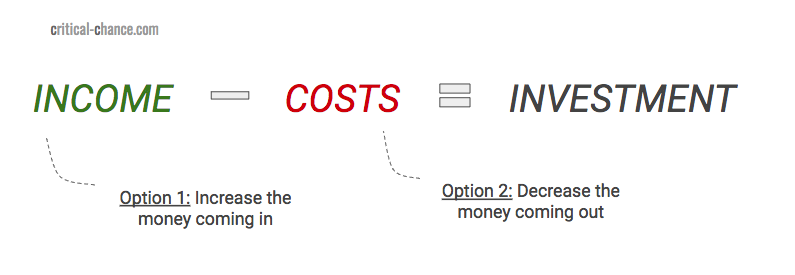

The Power of Subtracting

The common-person thinks the only path to wealth is to generate more income. While making more money can help, there’s a second part to the equation, one which is often times ignored: minimizing costs.

“Reducing your spending [costs] is financially more efficient than earning more money.

For every additional dollar of earnings you plan to save, you will likely have to earn $1.40 because you have to pay income taxes.

However, every dollar unspent can be invested [immediately for compounding gains].”

LESSON: While most people focus on gains, you should also consider the power of subtractions. You don’t need to add another book to your reading list, you need to remove one not servicing your needs.

Index Fund vs. Fund Managers

Choosing a single winner is far harder than it may appear. While markets are meant to show the “real value” of an asset, it’s nearly impossible to predict their future value. You’ll fare much better by holding the entire market; when the economy wins, you win too.

The fastest way to get rich in the stock market is to own the next Microsoft. The fastest way to lose all your money is to own the next Enron. Identifying them in advance is impossible.

However, you don’t have to identify them in advance to make a healthy return on your investment. If you buy an S&P 500 index fund, your investment is highly diversified and its performance will match that of 500 leading U.S. corporations’ stocks.

Over 10 years, the average expert-picked stocks were up an annualized 8% compared to the market index return of 9.5%.

A 1.5% difference may not seem like much, but compounded over a lifetime it makes a tremendous difference.

LESSON: Don’t waste your time trying to find a needle in a haystack. Sure you may get lucky sometimes, but odds are you’ll fare better by holding a small piece of everything. Worry about getting the market (macro) right, not the stock (micro).

RIP Jack, you will be missed.