Warren Buffet has an interesting principal he follows.

At the end of each year, a company gets to decide what to do with their earnings. Some companies issue a portion of the money to their shareholders; this is called a dividend. Most investors love it, in fact some design their portfolios to exclusively invest in companies that provide annual dividends. Warren on the other hand? He HATES investing in these companies.

Why? When you receive a dividend, you realize gains, which means you have to pay taxes each year.

Warren would rather the money was reinvested into the business to help it grow.

First off, this allows him to avoid taxes for as long as he can. But if we remember the rules of compounding, it allows his money to stay in the system and work even harder. Warren wants to be taxed only once, at the very end when the journey is over, not throughout.

Buffett principal #2: Never take your money out

The Aggregation of Gains

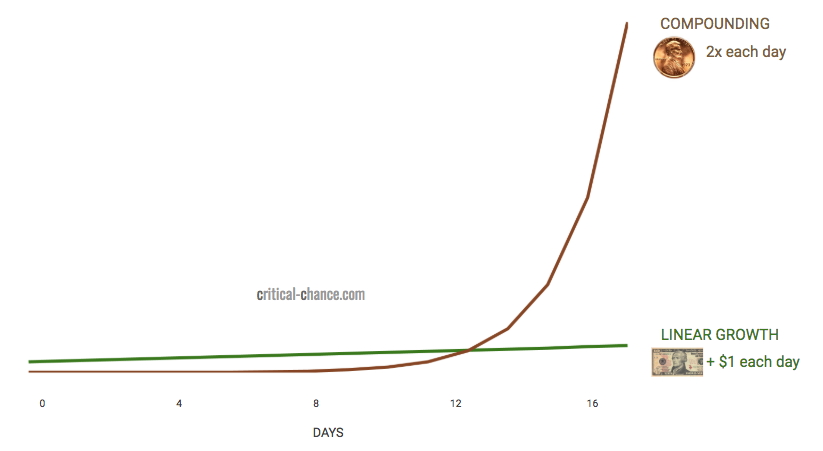

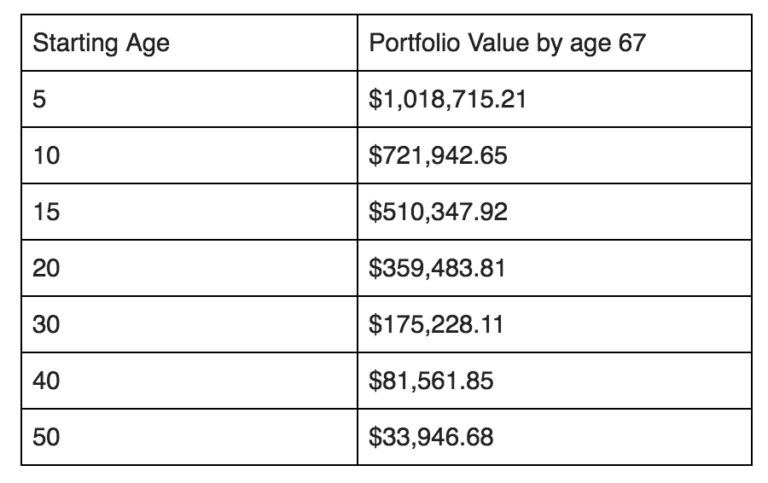

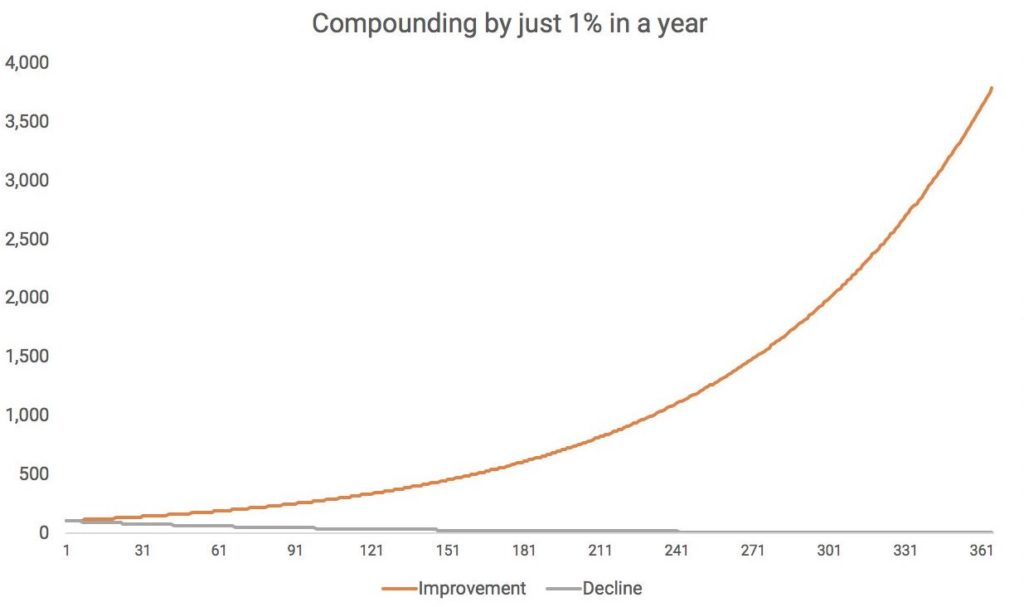

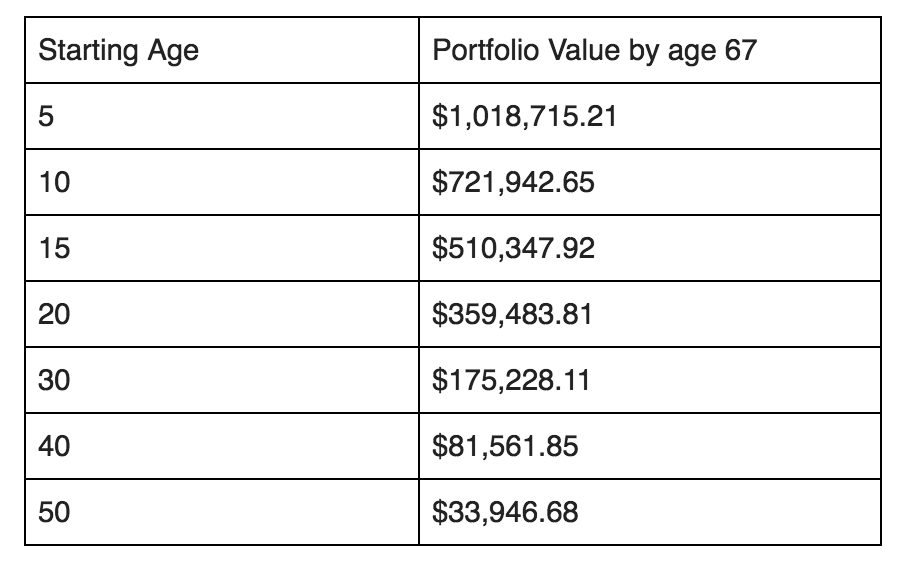

The first rule of compounding is to start as early as you can.

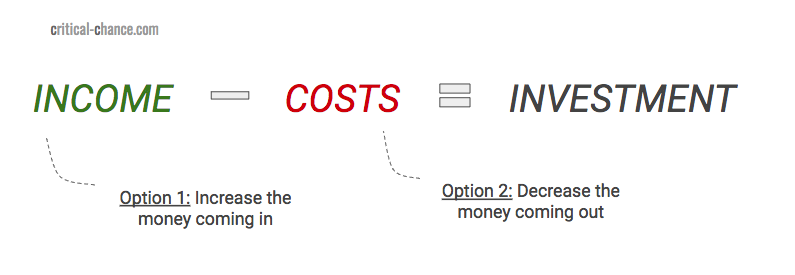

But once your money is in, we want to optimize towards growth – this means paying as little as possible.

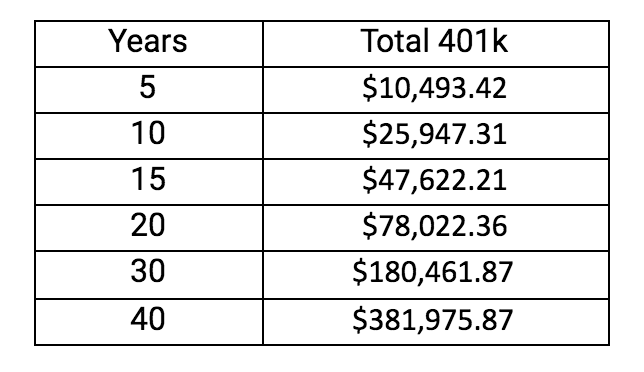

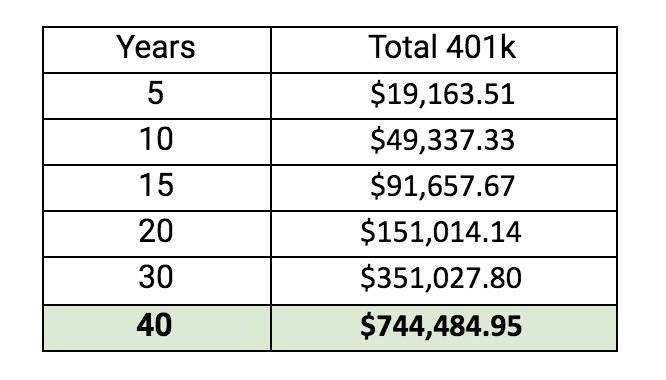

“The objective is to buy a non-dividend-paying stock that compounds for 30 years at 15% a year and pay only a single tax at the end of the period. After taxes this works out to a 13.4% annual rate of return.

Charlie Munger, 1998

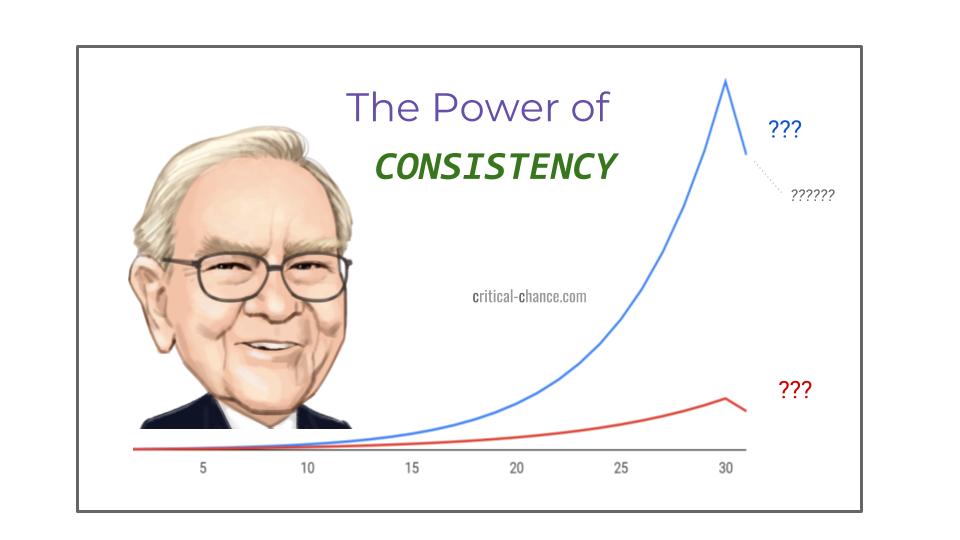

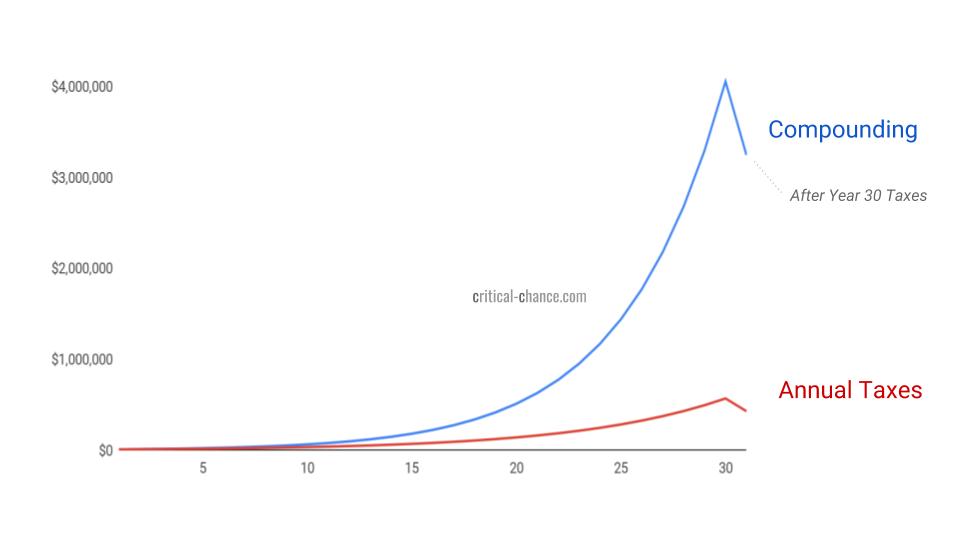

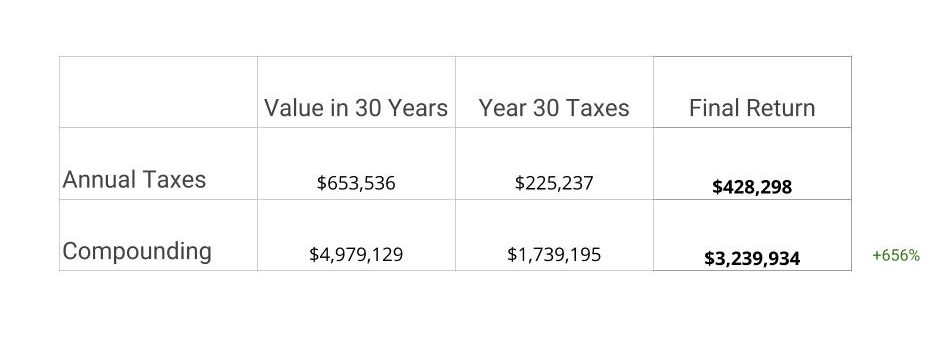

If you invested $10,000 with Warren Buffett, at his annual rate of return of 23%, the following chart shows you the amount you’d have in 30 years, based off if you paid taxes each year versus allowed the money to keep compounding.

Assumes 23% compounding annual rate, blue line allows money to compound, red line removes taxes at 35% rate each year

Breaks vs BRAKES

Breaks are healthy – they allow us to recover and admire our results.

Trouble comes when we allow a short break to turn into hitting the brakes (that is, stopping completely).

Here’s what what I mean:

- Health – When we feel physically in shape, we decide to stop exercising – a few days becomes a few weeks

- Learning – When we believe we’ve mastered enough, we decide to stop learning – binge reading becomes binge television

- Relationships – When we sense our connections are strong, we decide to stop building them – personal texting becomes singular social media posting

Warren’s principal reminds us of the power of pausing too often or for too long.

Once you stop showing up, you stop gaining.

Keep It Going

You’ve decided to start (that’s great!), but don’t underestimate the importance of continued hustle. The laws of compounding don’t care if you’ve had a bad day, or it’s a busy week.

When we decide to follow through, we continue to gain, period.

So wherever you are, keep it up, and just like Warren you too will enjoy the aggregation, not of a single year, but an exponential 30 years.

Getting up when others won’t is what makes all the difference.

And who knows, that determination might be worth an extra $2.8M dollars, in whichever domain you’re compounding.

Post inspired by:

Buffettology: Unexplained Techniques That Have Made Warren Buffett by Mary Buffett